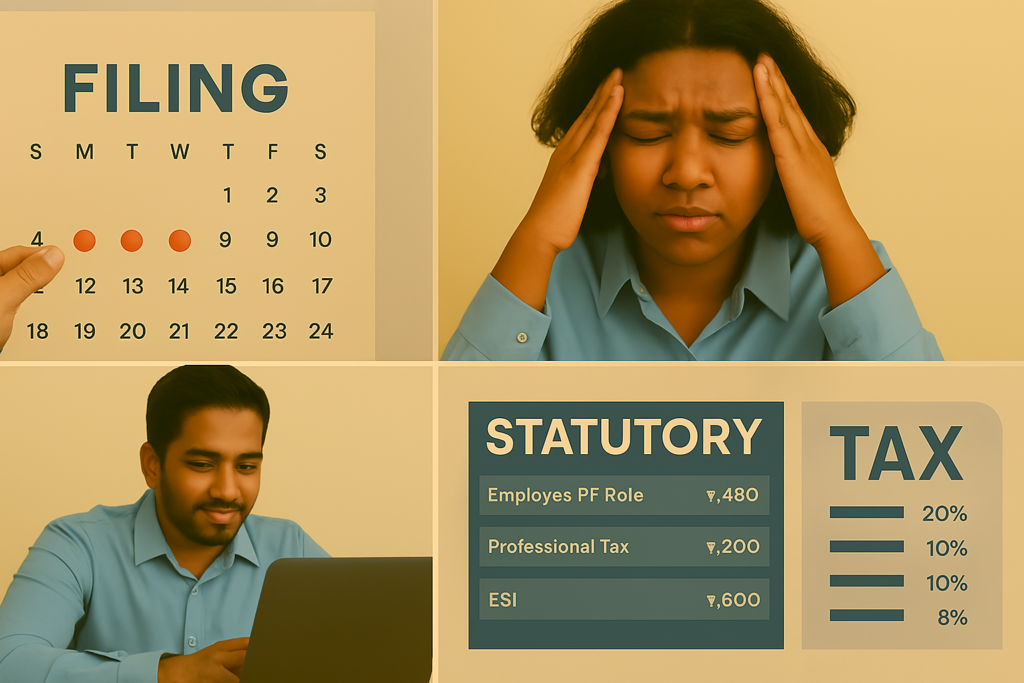

“Have we filed our TDS return?” “When is the GST deadline?” If these regularly scheduled panic attacks are consuming you, you are not alone. Many Indian business owners experience statutory compliance like a tightrope walk with no safety net. One missed deadline and here comes the government fines, legal notices and a loss of credibility.

That is exactly why Savi3HR created a “Done-For-You” compliance calendar powered by our expert outsource bookkeeping services and real time tax filing services to allow you to stop worrying and start focusing on elevating your business.

The Everyday Chaos of Compliance (And How We Fix It)

Imagine a situation: A manufacturing company with about a hundred employees kept missing statutory deadlines for PF deposits and GST filings. The problem was not the company’s negligence but the fact that no one knew who was tracking what. When that manufacturer came to us, they had huge amount in penalties in a year.

What we implemented Through our Bookkeeping Services

Digital compliance calendar to centralize all compliance obligations

Auto reminders along with human intervention

Integrated bookkeeping dates with compliance deadlines

Today, after implementing our suggested corrective measures, the manufacturer has not missed a single statutory deadline in the last one and a half year

Real Pain Points, Real Solutions

- Too many moving parts. Most SMEs can hardly keep up with GST, TDS, PF, ESI and labour compliance. Our bookkeeping services sync every financial movement with statutory due dates in one dashboard.

- No internal expertise. Not every business can afford a full-time compliance team. We are your external CFO office and your filings are accurate, timely and penalty free.

- Reactive, not proactive. Most companies scramble in the last moments. When we prepare your tax filings for you, you are always ten steps ahead. We do not wait until the last date to let you know, we prepare you for the next one.

The Real Cost of Missed Deadlines

As reported in a 2023 industry analysis, collectively, Indian SMEs lose over ₹12,000 crores in an anum on regulatory fines and interest. It is not just paperwork – it is lost profit, lost reputation and compounded by stress.

Why Choose Savi3HR?

Over 25 years of compliance, tax and HR management expertise

Dedicated compliance team with 100% on-time statutory filing record

Integrated digital tools for tracking, alerts, and documentation

Personalised support across GST, PF/ESI, PT, TDS, Shops & Establishment

Transparent pricing and zero hidden charges

Never Miss a Deadline Again

Our clients do not chase dates, we handle that. With Savi3HR, your tax filings are timely, your records remain clean and your peace of mind remain intact through our outsource bookkeeping services .

Connect with us today for free consultation and quote.

Stop surviving compliance. Start owning it, with Savi3HR by your side.